kern county property tax phone number

Tax rates are calculated in accordance with Constitutional Article 13a and presented in percentage of value. How the Court Determines if a Case Can Transfer.

Jordan Kaufman Kern County Treasurer Tax Collector

Calaveras County Superior Court.

. Questions regarding the calculation of your tax or the value placed on your property should be directed to the Rio Grande County Assessor 719-657-3326. The Rio Grande County Treasurer is also the Rio Grande County Public Trustee. Alameda County Superior Court.

Butte County Treasurer - Tax Collector. Tehama County Clerk and Recorder 633 Washington St Room 11 Red Bluff CA 96080 Phone. How to Look Up Los Angeles County Property Records.

Free Kern County Recorder Of Deeds Property Records Search. If you have questions regarding your propertys value the Assessor-Recorder can be reached via their website or by phone at 661 868-3485. California Department of Corrections Rehabilitation.

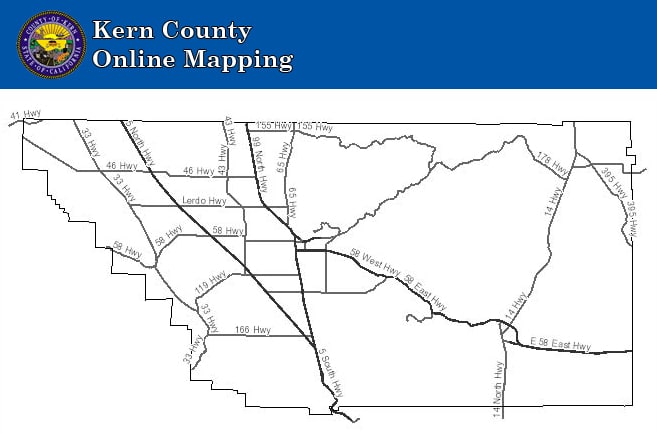

If you receive a tax notice and no longer own the property contact the Treasurers office 719-657-2747. 530 527-1745 Return to Top Trinity County. Search interactive Kern County GIS map for property tax and assessment records.

Search Travis County TX property records by Owner Name Account Number or Street Address. The petitioner filed. Kenneth Hahn Hall of Administration 500 West Temple Street Room 225 Los Angeles CA 90012-2770 Toll-free Phone.

Pro members in Travis County TX can access Advanced Search criteria and the Interactive GIS Map. Search by parcel number address or intersection. All members can search Travis County TX appraisal data and print property reports that may include gis maps land sketches and improvement sketches.

Find Kern County residential property records including deed records titles mortgages sales transfers ownership history parcel land zoning structural descriptions valuations tax assessments more. Map also provides zoning flood plains parks trails schools soils and more. Individuals can make requests for records at.

Additionally the Office of the Assessor maintains information on property value and tax. Alameda County Central Collections. California Code of Civil Procedure Section 3975 allows a family law case to be moved to another county if the petitioner can prove one of the following situations to the court.

Tax amounts are determined by the tax rates and values.

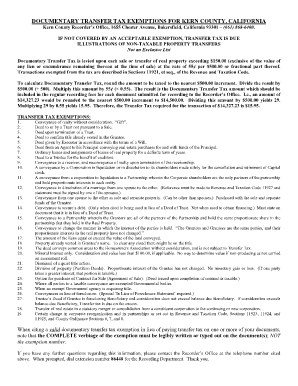

Fill Free Fillable Kern County Clerk Pdf Forms

Kern County Property Taxes Due Next Week Kget 17

A California County That S Making Good News Area Development

Home Water Association Of Kern County

Supervisorial District 4 Map Kern County Ca

Jordan Kaufman Kern County Treasurer Tax Collector

Interactive Maps Kern County Planning Natural Resources Dept

Kern County Property Tax Exemption Fill Online Printable Fillable Blank Pdffiller